What Is The Cost Of Borrowing Money

The loan term refers to how long the loan will last if you only make the required minimum monthly payments. When you're choosing the term, consider its impact to your total interest costs. A loan with a longer repayment period may have a lower monthly payment, but it can also increase the total amount you pay over the life of the loan. If you choose a longer term, remember you can still pay less interest over time by making additional payments toward principal.

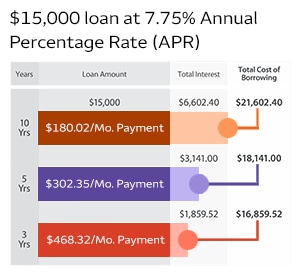

Payment terms affect your monthly costs

Loan interest rates, payments, and terms are closely related. Keep in mind that changing or adjusting one of these factors will result in changes to the others.

Loan interest rates, payments, and terms are closely related. Keep in mind that changing or adjusting one of these factors will result in changes to the others.

For example, with a $15,000 loan at 7.75% APR, and a payment term of 3 years, you would pay $468.32 per month. But if you changed the term to 5 years, you'd lower your monthly payment to $302.35 per month.

Keep an eye on the total money you will pay back over the loan term (your total cost of borrowing). Most loans allow you to pay more than your scheduled monthly payment. The more money you are able to put toward the principal, the faster you'll pay off your loan - and the less you will pay in interest.

This chart is for illustration purposes only.

Tip

Try to add an additional amount towards your principal in your monthly payment. Even a small amount each month can shorten the term of the loan and result in lower total interest costs.

What Is The Cost Of Borrowing Money

Source: https://www.wellsfargo.com/goals-credit/smarter-credit/manage-your-debt/total-cost-of-borrowing/

Posted by: falktrocce.blogspot.com

0 Response to "What Is The Cost Of Borrowing Money"

Post a Comment